This is the topic of a talk I’m giving this week at a customer loyalty conference in Melbourne. It is in response to another talk entitled “Are you going to NPS me? No I’m not” in which Dr Dave Stewart of Marketing Decision Analysis will be presenting the case that Net Promoter is a deeply flawed concept. Dave will say that NPS should be discarded by organisations that espouse customer advocacy. To be honest, Dave’s position is close to what I thought of the Net Promoter Score concept when it was first introduced by a pretty smart academic and business consultant called Fred Reichheld back in 2003.

Net Promoter Score

Reichheld’s basic premise was that you only need to ask one question in order to understand if a customer is going to stay loyal to you or not. The question is: “How likely are you to recommend us to a friend or colleague?” Fred, being the excellent marketeer that he is, proclaimed the benefits of this Net Promoter Score (NPS) concept in respected publications like the Harvard Business Review. He then promoted it in his own book The Ultimate Question which came out in 2006, shortly after I took on the CEO role here at Deep-Insight. Since then, NPS has became very popular as a customer loyalty metric.

However, NPS has also attracted some heavy criticism. Tim Keiningham gave NPS a particularly scathing review saying that he and his research team could find no evidence for the claims made by Reichheld. (It should be said that Keiningham worked for the market research company Ipsos so his views may not be completely unbiased.)

At that time, my own view was that NPS was probably too simplistic a metric for business-to-business (B2B) companies. I also felt that Deep-Insight’s own customer methodology – which also included a ‘would you recommend’ question – was a much better fit for complex business relationships. And if I’m honest, there was an element of ‘Not Invented Here’ going on in our own organisation as well.

So we decided to ignore NPS.

The Rise of NPS

But here’s the thing: our customers didn’t ignore it. When we ran customer feedback programmes for customers like Reed Elsevier and Atos in the UK, ABN AMRO in the Netherlands, Santander in Poland, and the Toll Group in Australia, they would all ask: “Can you add in the NPS question for us – we have to report the numbers back to headquarters?” Of course, being the good marketeers that we were, we duly obliged. However, we always gave the results back in a separate spreadsheet, so that it wouldn’t contaminate our own reports and our own wonderful methodology!

Roll the clock forward to 2013. NPS still hadn’t gone away. In fact it had become even more popular. It was particularly popular with large international companies where a simple understandable metric was needed to compare results across different divisions and geographical areas. And when I finally looked into it, I discovered that Deep-Insight had actually been gathering NPS data from customers across 86 different countries since 2006.

Is NPS a good predictor of loyalty?

Around the same time we also did some research into our own database to find out what really drove loyalty and profitability in our clients. Now this is not an easy thing to do, as many of you who have tried will know. But where we had several years of customer feedback data, it was relatively straightforward to analyse how many of our clients’ B2B customers were still with them. If they have deliberately defected, we investigated if that defection could have been predicted by a poor Net Promoter Score, or by any of the metrics in our own CRQ methodology.

I have to say that the results were quite interesting. A low ‘Likelihood To Recommend’ was not the BEST predictor of customer defection. However it was actually a pretty good predictor. Deep-Insight’s overall Customer Relationship Quality (CRQ) metric was a slightly better predictor.

A poor Commitment score – one of the key components of CRQ – was the best predictor of whether a B2B client was going to defect to the competition or not.

So there we had it: NPS did actually work.

It worked not because it’s the BEST predictor of whether a client was going to defect, but because it’s a GOOD predictor, coupled with the fact that NPS has been embraced by some of the world’s leading organisations as an easy-to-use and internationally-accepted customer benchmark.

At Deep-Insight, we came a little late to the party. We only incorporated Net Promoter Score into our customer methodology in early-2014. Today we find that the combination of NPS and our own CRQ metrics works really well for our clients.

The future for NPS

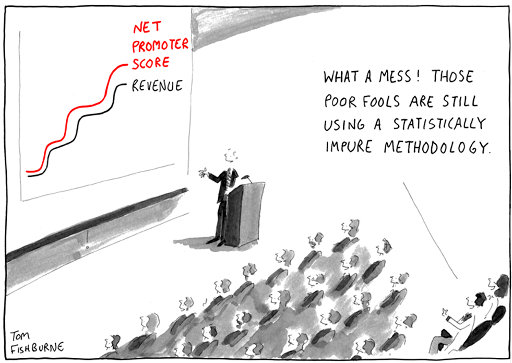

Now let’s go back to the cartoon at the top of the blog (and thank you to the wonderful Tom Fishburne for allowing us to use it). If there is a statistically purer methodology than NPS, why not use that instead?

The answer is simple: most senior executives aren’t interested in re-inventing the wheel. They are much more interested in taking the feedback from their clients and acting on it, so that they can protect and enhance the revenues they get from those clients.

So for those B2B executives who are wondering if NPS is the right customer metric for them or not, I would suggest that you’re asking the wrong question. What good CEOs and Sales Directors are asking these days is:

“If my Net Promoter Score is low or if I have a lot of Opponents and Stalkers as clients, what do I do?”

In fact, the really successful CEOs and Sales Directors are spending the time thinking about the challenges of putting a really effective customer experience (CX) programme in place, rather than worrying about the purity of the metrics. That’s what you should be doing too.