New Year’s Resolution: Measure Net Revenue Retention

Do New Year's resolutions work?

A few weeks ago, the Washington Post ran an article entitled Here’s a better way to make New Year’s resolutions.

In the article, Lindsey Bever points out that the conventional wisdom is that New Year’s resolutions typically fail. However, a closer look at the data shows that many people do benefit from making resolutions. Lindsey also summarises the tips for improving your odds of success if you do make a New Year’s resolution.

Lindsey’s tips in that Washington Post article are fairly straightforward:

- Set your New Year’s resolutions at the right time

- Make an explicit plan for achieving your goal

- Choose a goal you’ll enjoy

- Subtract things from your life

- Forgive failures

We’ll come back to those tips shorty. But first, let’s try to apply that Washington Post’s article to the B2B world.

The New Year’s resolution that I would like ALL B2B leadership teams to make this year: Measure Net Revenue Retention (NRR) in 2024.

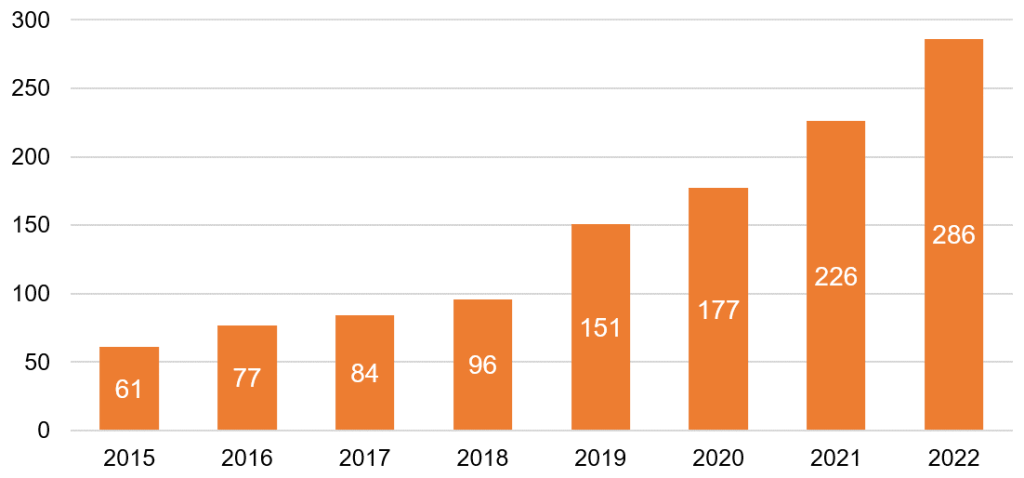

Revenues at Kainos, excluding acquired companies (£m, 2015-2022)

What is Net Revenue Retention (NRR)?

The easiest way to explain NRR is to use a real-life example. Take a B2B company call Kainos – I wrote a blog about them a year ago – which has been operating at an average Net Revenue Retention (NRR) rate of 110-120% ever since it went public in 2015.

(See the box below for a more detailed explanation of Kainos’ NRR figures.)

Kainos may not be a household name but since it floated on the London Stock Exchange way back in 2015, the company has been growing revenues organically by 20-30% a year. That’s 20-30% a year every single year. Without fail. Kainos floated at a share price of £1.39. On 1 January 2024, its share price was over £10.

If you’re a member of a B2B leadership team that would like to emulate Kainos’ success, read on!

Kainos is a high growth, high profit company precisely because its NRR figures are so strong. In its nine years as a publicly-quoted company, its NRR has only once dropped below 100%. In 2019, it hit 139%. Kainos is certainly ‘Best in Class’ and is a role model for any company trying to achieve above-average revenue and profit growth.

NRR is not a difficult concept to grasp but few senior executives truly understand the power of monitoring their company’s NRR performance. The reason for this is that most B2B leadership teams don’t understand how much it costs to land a ‘Net New’ client (brand new logo). If they did, they would become obsessed with retention in general, and NRR in particular as a key metric to monitor.

That’s why the adoption of NRR should become your main corporate New Year’s resolution in 2024.

NRR Explained

Net Revenue Retention is not yet a commonly-used financial term in business even though it is a well-known term in Software as a Service (SaaS) companies.

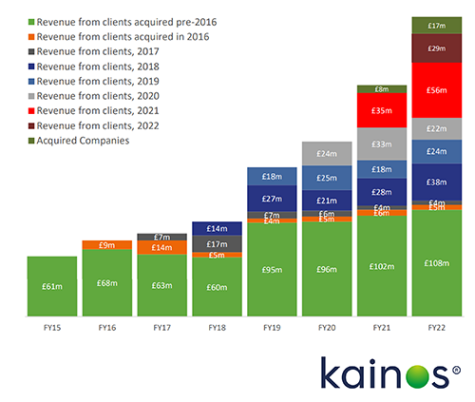

Let’s look at Kainos’ revenues from a NRR perspective. Let’s group revenues by the year in which they were acquired.

The graph on the right shows that in 2015, Kainos generated revenues of £61m.

Now suppose Kainos signed up no new clients in 2016. Its revenues would still have grown as the clients that were on its books in 2015 generated revenues of £68m in 2016.

Here’s the NRR calculation:

Kainos’ Net Revenue Retention for 2016 is:

NRR = £68m ÷ £61m = 111%

Is it worth the effort?

Yes! But it does require effort – not just in measuring NRR, but making the changes that are required to drive that NRR figure up.

Here’s why it’s worth it. Let’s say you and your fellow directors are running a B2B company with an annual turnover of €100m. You have an Enterprise sales team that’s delivering €10m in new sales each year and you feel you’re doing a good job for you’re shareholders.

But you’re not growing and your shareholders aren’t ecstatic.

That’s because you’re operating at a NRR of about 90%. In other words, the clients that accounted for €100m in revenues in 2023 will only generate €90m for you in 2024. So you need €10m of ‘New Logo’ sales to make up the gap. In other words, your Enterprise sales team are working their socks off but all they’re achieving is to help you stand still.

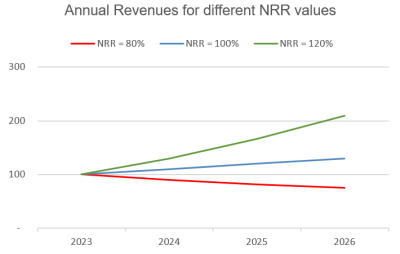

Impact of Improving NRR – taking a 3-year view

So let’s see what happens if you manage to retain your existing customers for a little longer or if you expand your footprint across those accounts a little better.

If you do the right thing for, and by, your clients, your NRR should increase to 100%.

That would turn your €100m company into a €130m company in three years – see graphic on the left. Now you’re growing again.

If you could get your NRR to 120% which is where truly market-leading companies operate, you would more than double the size of the company over the next three years.

Of course, the reverse is also true. If your NRR is only 80%, then your Enterprise sales team (who currently do €10m a year in New Logo sales) have no chance of plugging that €20m revenue gap each year. So the company goes into long-term decline.

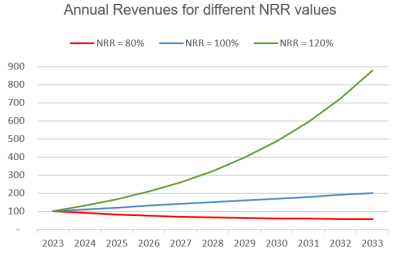

Impact of Improving NRR – taking a 10-year view

The real benefit comes when you replicate these NRR achievements over the longer term.

Suppose you can maintain a NRR rate of 120% for 10 years. Yes, that’s a tall order. But it can be done. Well-run companies like Kainos have achieved this. The most successful software companies often exceed this rate.

The graph shows the impact very clearly. You will increase revenues almost ninefold over ten years with a NRR of 120%.

Even at 110%, you will still double the size of the company in a decade purely through organic growth.

Of course, if you’re operating at a NRR of 80%, your company will lose almost half its revenues over a 10-year period, and probably more than 90% of its share value. And you’ll be out of a job well before those ten years are up.

Tips for Success

Let’s go back to those tips from Lindsey Bever at the Washington Post at the start of this blog:

- Set your New Year’s resolutions at the right time. Honestly, there’s no better time than now. It may not be the start of your financial year – most UK companies have a financial year beginning in April – but that gives you a few months to try it out so that you can get your company’s financial systems tracking NRR formally from 1 April 2024.

- Make an explicit plan for achieving your goal. Table this topic at your January leadership team meeting. Challenge yourselves to be bold, and put the customer at the heart of everything you do. (This is the key to improving your NRR figures.)

- Choose a goal you’ll enjoy. If you can achieve a NRR greater than 100%, you’re definitely going to enjoy this New Year’s resolution. If you get anywhere near 120%, your board and shareholders are going to enjoy it even more!

- Subtract things from your life. If you’re going to add NRR to your leadership team’s KPI list, drop a couple of your existing KPIs. Do a spring clean of your management dashboard. Are all those metrics really necessary? Which ones can you drop?

- Forgive failures. Change is not easy and the road to success is challenging. You won’t get everything right first time. But the journey will be worth it. Read through that Kainos blog and interview with former CEO Brendan Mooney again for a little inspiration.

Happy New Year!