Some years ago, the focus of NPS discussions changed. At least, in the USA they did. It used to be: “How do I measure NPS?” and now it’s: “How do I improve my Net Promoter Score?”

Remember that Net Promoter Score is an American metric for customer advocacy. Europe is still a few years behind the USA. The topic of how to improve NPS results will dominate executive leadership discussions in Europe for the next few years. If you’re a leader in a European B2B company that is already measuring NPS, this blog is for you. It’s about the 5 actions to improve your Net Promoter Score.

Insight from a Decade’s Worth of B2B NPS Data

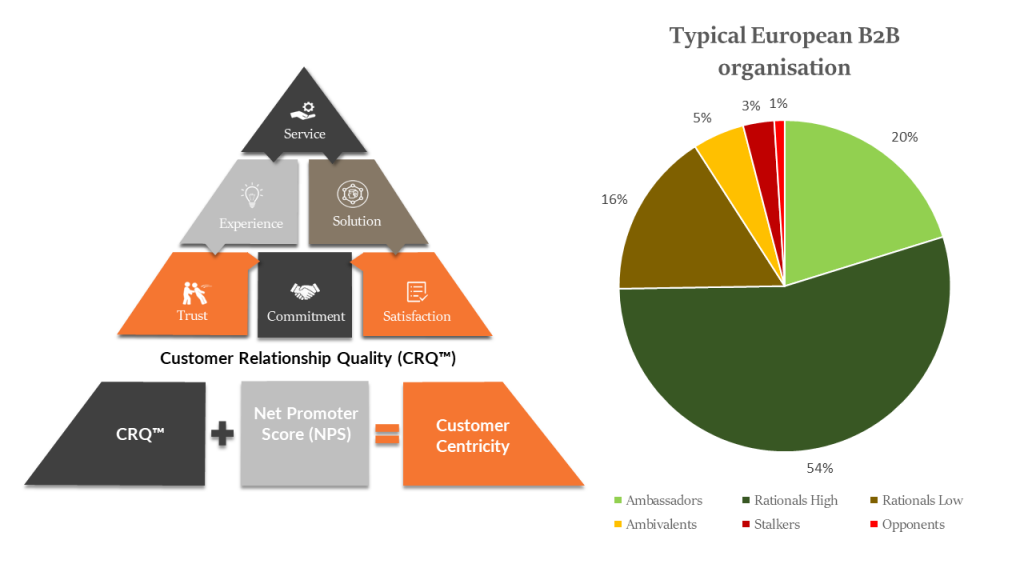

Deep-Insight has been gathering NPS data since 2006. We gathered this data from B2B firms operating across a variety of different industries in over 80 countries. A few years ago, we integrated NPS into our Customer Relationship Quality (CRQ) methodology. We now have tens of thousands of data points – exclusively from B2B companies – showing which items are strongly correlated with NPS and which are not.

A quick word on our terminology:

We call accounts where you have the strongest and deepest relationships Ambassadors. An Ambassador typically has many ‘Promoters’ and few ‘Detractors’. We call companies at the other end of the relationship spectrum Stalkers and Opponents. These accounts typically have few ‘Promoters’ and large numbers of ‘Detractors’.

The pie chart on the right shows a client portfolio for a typical European B2B organisation. Most accounts have good relationships, and a third have excellent relationships.

As the graphic on the left shows, the key elements of any business relationship are Trust, Commitment and Satisfaction. Each of these elements is highly correlated with a customer’s willingness to recommend. In other words, their willingness to give you a good Net Promoter Score.

Trust, Commitment and Satisfaction are only the outcomes of other elements of performance so we need to delve deeper. By doing so, we’ll find out which areas to concentrate on in order to improve a company’s Net Promoter Score.

5 Actions to Improve your Net Promoter Score

Based on more than a decade’s worth of data, we know the five key actions to improve your Net Promoter Score.

First things first. Any large account is likely to have a combination of Promoters, Passives and Detractors. Different strategies are required for dealing with each category. The actions required to turn Detractors into Passives are not the same as the actions required to turn Passives into Promoters.

Here’s a quick summary of those 5 actions.

Turn Detractors into Passives

- 1. MAKE YOUR CUSTOMERS FEEL VALUED. The one thing you should do, above everything else, to turn Detractors into Passives is to have empathy with them. Show a willingness to engage. Listen to them and make them feel valued. People give extremely low advocacy scores (0 – 3 out of 10) when they feel unloved and frustrated. Unloved because they are ignored. Frustrated because they believe you are not interested in solving their problems. Even if there is little you can do immediately to fix their problems, tell them that you understand how they feel. Let them know you will do your utmost to address their issues. But be honest. If it’s going to take six months, don’t say six weeks.

Convert Passives into Promoters

- 2. DIFFERENTIATE YOURSELF FROM YOUR COMPETITORS. The more you differentiate yourself from the competition, the more you will be seen as ‘Leading Edge’. Our analysis tells us that if you are perceived as a leading-edge company, your NPS score will be higher. By the way, there’s no point in trying to discuss innovation with Detractors. They’re not in listening mode. What they want is for you to address their immediate problems. Do that and you will earn the right to chat about innovation. Not before.

- 3. PROVIDE VALUE FOR MONEY. This is linked to the previous point. The more differentiated you are and the more unique your offering is, the greater the value you deliver to your clients. Passives think you provide good value for money. Promoters think you provide excellent value for money. Price is rarely the issue. Focus of what you can do to increase the value of what you deliver rather than on the price at which you deliver it.

Actions – All Customers

- 4. MAKE IT EASY FOR YOUR CUSTOMERS TO DO BUSINESS WITH YOU. Regardless of whether you are a Promoter, Passive or Detractor, there is a high correlation between ‘Ease of Doing Business’ and NPS. Become less bureaucratic. Break down the silos between departments. Build cross-functional teams. Look at your processes and simplify them. Get your clients involved. Just ask them – they want to be included.

- 5. BE PROACTIVE. Customers want you to respond quickly and effectively to their needs. That means not just reacting to problems as they occur. It means anticipating problems BEFORE they occur. That’s what good account management is all about.

If you’re interested in turning NPS data into a full-fledged Customer Experience (CX) programme that improves retention rates and revenues, get in touch with us. We’d love to hear from you.