How Do You Measure B2B Customer Experience?

B2B Customer Experience

A lot of words have been penned on the topic of customer experience (CX) in recent years. But here’s the thing. Most of what’s written relates to CONSUMER experience.

There really is very little out there about CX purely written from a business-to-business (B2B) perspective. That’s really surprising when you consider that B2B commerce is significantly larger than its business-to-consumer (B2C) counterpart.

So let’s try to redress that with this blog. Let’s explore how CX is, and should be, measured in B2B companies.

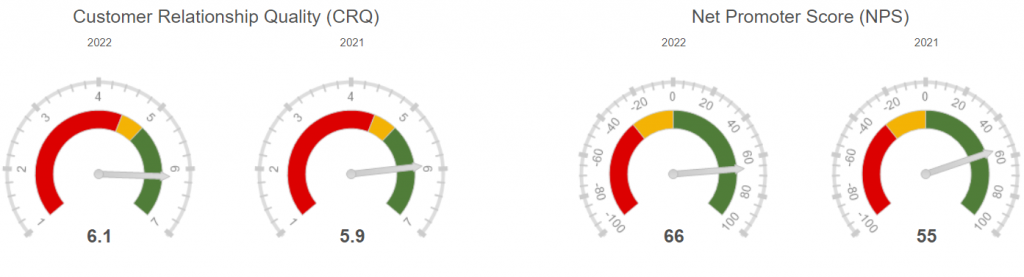

The answer to the first question is easy. Most large B2B companies use Net Promoter Score these days. The second question – how should CX be measured – is harder to answer. There are other measurement systems out there so is NPS really the best metric? Does it even work in a B2B context?

What is Customer Experience anyway?

Before we answer these questions, I need to provide a little bit of context to how we got to where we are today. The reason is that the term ‘Customer Experience’ is actually a very recent term. As the Box below shows, the term was first coined in 1999.

‘Customer Experience’ was called something else for most of the last century. In fact, CX was called a lot of different things over the last 100 years.

Professor Saba Fatma traces the term Customer Experience back to a 1999 book by Joe Pine and James Gilmore called The Experience Economy: Work Is Theatre and Every Business a Stage.

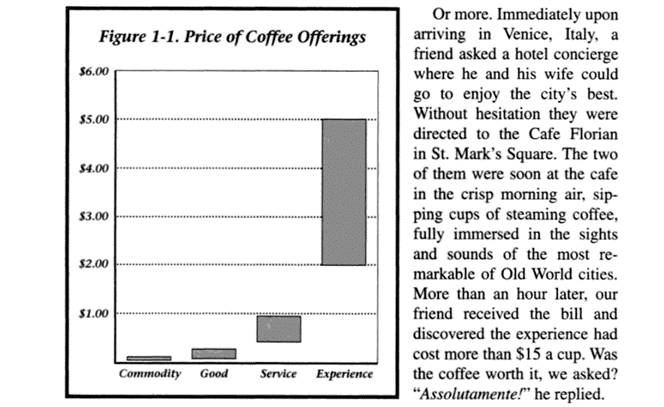

The book itself starts with a wonderful example of how the value in a cup of coffee is in the experience, rather than the quality of the underlying commodity (in this case, the humble coffee bean).

This example above is from the consumer, or B2C, world but the concept is equally applicable to the B2B world. Experiences are subjective. They tap into the emotional as well as the rational side of the brain.

A Brief History of CX in the 20th Century

So if CX is a term that only came into common usage at the turn of the 21th century, what was it known as before then? Time for a short history lesson.

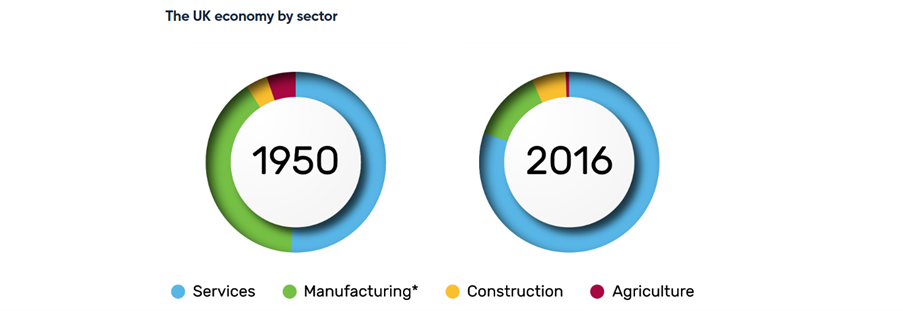

A hundred years ago, there were practically no formal customer-related performance measures in existence. That’s not to say manufacturing companies didn’t think about the customer. And it was all manufacturing back then. The services economy didn’t really take off until much later. In fact, it was only after the end of the Second World War that services became the dominant component of western economies. The graphic below shows that in the UK, the services sector hit 50% in 1950. Today, it’s closer to 80%.

Back in the 1950s, it made sense to focus on product quality. By then, management gurus like W. Edwards Deming, Joseph Juran, and Philip Crosby were rolling out a series of techniques and approaches for Total Quality Management, or TQM. That’s what customer experience was all about in those days.

By the 1960s, management theory had become a little more sophisticated. People started thinking not just about the quality of the product being manufactured, but also about whether the customer was satisfied with the product. Did it meet expectations? Did it exceed expectations? This is when Customer Satisfaction, or CSat, measurement started to take off.

It’s strange to think that this was the first time that management gurus started thinking explicitly about the customer.

By the 1980s, most economies in the world were dominated by services rather than by manufacturing. Service Quality became a fashionable, if fuzzy, topic led by American academics like Valerie Zeithaml and Leonard Berry. They proposed measuring concepts like reliability, responsiveness and customer care.

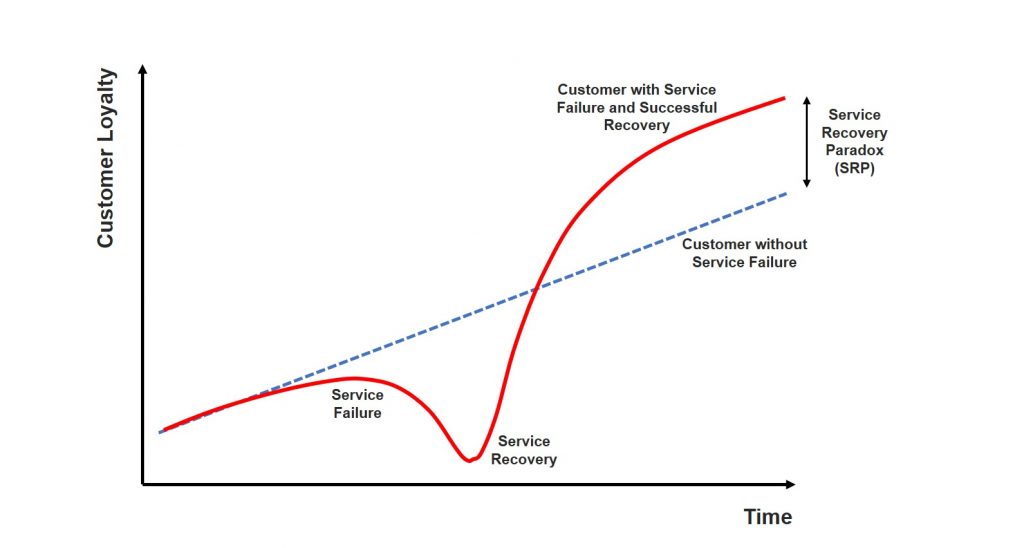

It wasn’t until the 1990s that people like Fred Reichheld (the guy who later came up with the concept of Net Promoter Score) really started thinking about the value of a customer over the lifetime of that person buying from a company, rather than just the value of the individual transaction. Customer Loyalty became the new buzzphrase. Reichheld’s book The Loyalty Effect is still one of the most sought-after management books of the last 30 years.

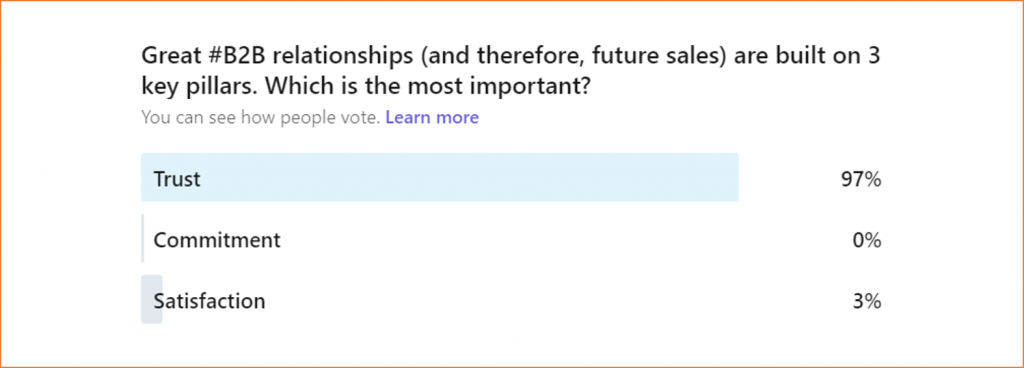

Also in the 1990s, another couple of American academics Morgan and Hunt came up with their views on the critical role of Trust and Commitment in business relationships. I’ve written about Morgan and Hunt before, in this blog.

Standing on the Shoulders of Giants

While CX is only a little over 20 years old as a concept, it is in fact built on a series of measures going back as far as the 1950s. Here’s the important thing. All of the concepts and measures in the following table are STILL relevant today. Fred Reichheld’s Net Promoter Score may be the most commonly used metric at the moment, but it’s not the only one. It’s not even the best one. But, in its favour, it is a simple concept to understand and equally simple for leadership teams and boards to implement.

ERA | MEASUREMENT |

1950s & 1960s | Total Quality Management (TQM) |

1970s | Customer Satisfaction (CSat) |

1980s | Service Quality |

1990s | Customer Loyalty Trust & Commitment |

2000s | Customer Experience (CX) Customer Experience Management (CEM) Net Promoter Score (NPS) |

When CX met NPS in the early 21st century, it seemed a marriage made in heaven. If the customer experience was excellent, we could measure just how good it was by asking a very simple question: “Would you recommend it?” NPS turned out to be a really straightforward way to measure consumer experience.

But is NPS a good metric to measure B2B customer experience? After all, the business world has had nearly a century of research into product quality, satisfaction, service quality, customer loyalty and business relationships. Should all these metrics be cast aside in favour of NPS?

As Isaac Newton famously said to a letter to Robert Hooke in 1675: “if I have seen further, it is by standing on the shoulders of giants.” CX professionals need to do the same when they consider what metrics to use in the B2B world. By all means, use NPS as a key metric. But also look back to the giants of the 20th century for inspiration.

Measuring B2B Customer Experience – is NPS Enough?

In short, No!

Fred Reichheld’s Net Promoter Score may be a great metric for measuring advocacy and is well suited to consumer environments and brands. Don’t get me wrong – it also has applicability in B2B environments even though I haven’t always been a fan.

The great strength of NPS – its sheer simplicity – also turns out to be its main failing.

Everybody understands intuitively the concepts of ‘Promoters’ and ‘Detractors’. They also grasp the ‘net’ concept. In other words:

NPS = % Promoters minus % Detractors

Boards and leadership team love the fact that it works on all types and sizes of customers. It’s easy to administer as it’s a single question. But therein lies the problem. It’s a single question. It’s very one-dimensional. It ignores all the giants of the 20th century and the work they did to understand what customer experience really involves, and how best to measure it.

NPS tells you whether you have a problem or not. It doesn’t give you the deep insights you need in complex B2B environments about the nature of the underlying problems. Or how to fix them.

Customer Relationship Quality (CRQ)

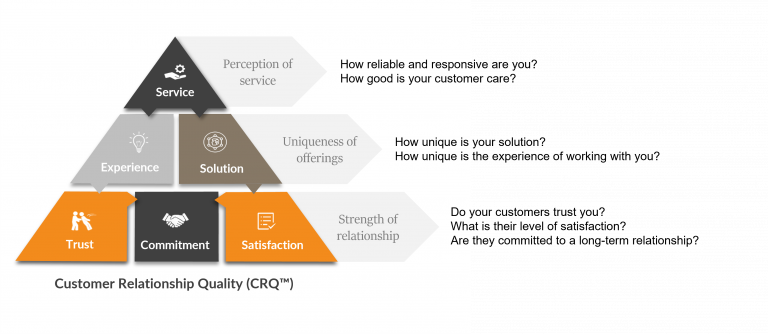

The answer to the question at the top of this blog – how should you measure B2B customer experience – is to combine the best of all worlds. To stand on the shoulders of the giants of the 20th century. And to do so in a pragmatic way.

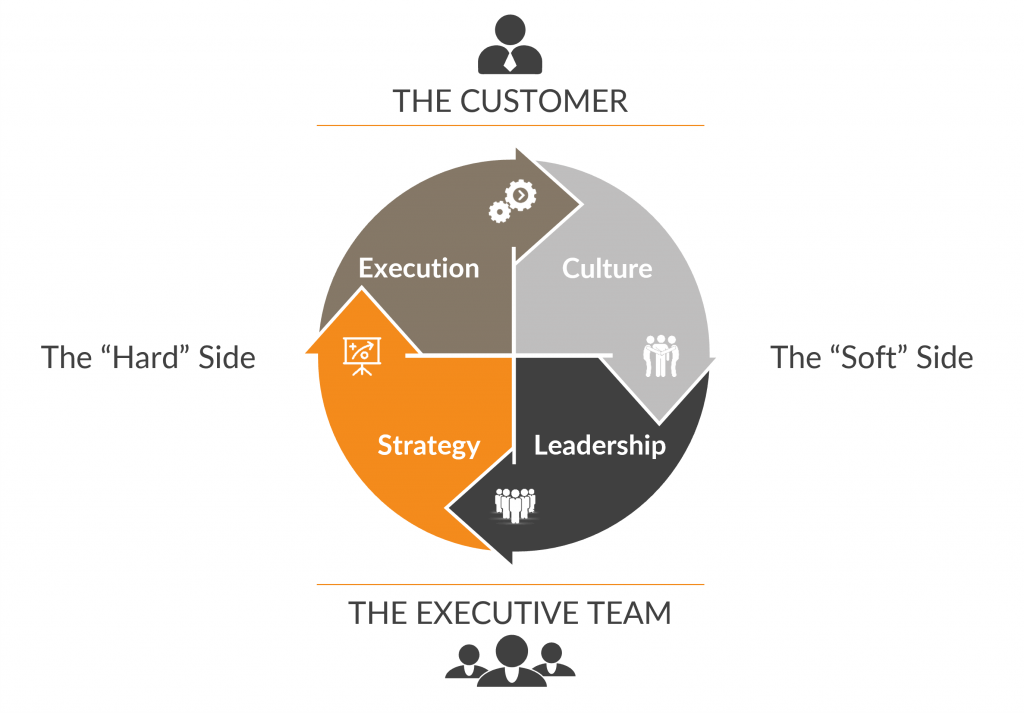

The Net Promoter question is worth asking, but in conjunction with a handful of other questions that are built on a foundation of nearly a century of good research. The result is a methodology that we call CRQ – Customer Relationship Quality – which covers six building blocks:

The approach we take at Deep-Insight is to stand on the shoulders of giants such as Deming, Juran and Crosby way back in the 1950s. I’ll come back to this topic again in the near future as I believe one of the most fundamental building blocks on customer experience for any B2B organisation is consistently good service delivery. Our own research shows that service delivery is the most important driver of long-term trusted relationships.

If you’re interested in finding out a bit more about customer experience and how to measure B2B customer experience, download our white paper by clicking on the image below.

Alternatively, give us a call to have a chat.