We’re coming to the end of another year and all in all, it’s been a good one for us here at Deep-Insight.

We are an Irish company – and proud of it – but our client base is international. Over the past 12 months, we have carried out customer and employee assessments in the UK, Netherlands, Poland and Australia as well as in our home market. That said, one thing that I have noticed in 2015 is a marked increase in activity from local companies. The Irish recovery is definitely under way.

NEW FACES

We’ve had a particularly busy year at Deep-Insight and as a consequence, there are a few new faces in the Cork office these days.

We’re delighted to welcome Jamie Jaggernauth, who is our latest addition to the Deep-Insight team.

Jamie hails from Trinidad and has worked in a variety of research roles in the Caribbean, UK and Ireland before joining Deep-Insight.

NEW CLIENTS

We also added a few new names to our client list during 2015, ranging from large well-established firms like the health insurer VitalityHealth in the UK to newer digital organisations like DoneDeal, which is Ireland’s biggest classifieds site (and which is part of the Norwegian-headquartered Schibsted Media Group).

In fact, DoneDeal celebrated its 10th birthday this year so a big happy birthday to John, Cathal, Kristian, Simon and the rest of the DoneDeal crew!

DEEP-INSIGHT’S OWN CUSTOMER ASSESSMENT

Earlier this month, we asked you what you thought of your relationship with us.

Now, I must admit I awaited these result with some trepidation. We think we deliver an excellent service to our clients but it’s always slightly scary waiting to hear what people ACTUALLY say about us and the benefits of working with Deep-Insight. It’s scary because we do take your feedback personally and it’s always a little nerve-wracking waiting for the results ton come through.

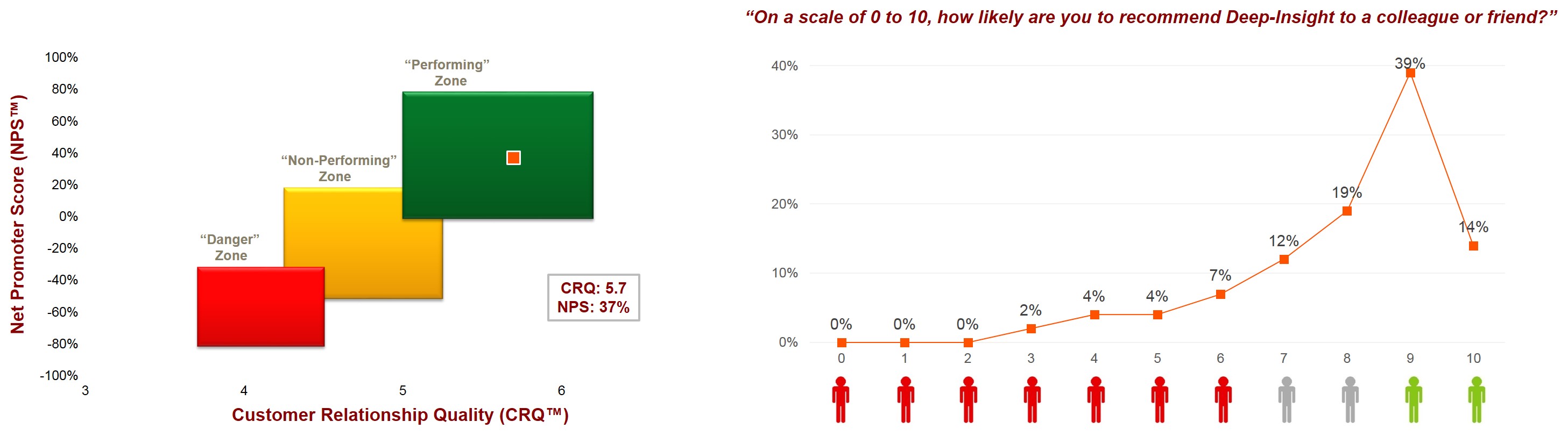

Last year, we had a Customer Relationship Quality (CRQ) score of 5.2 and a Net Promoter Score (NPS) of 17%. I was a little disappointed with those scores last year as they were down from the scores we received on our previous assessment and I felt that we could – and should – have done better.

A NPS of 17% is above average (more on average and good Net Promoter Scores here) but frankly it’s not that much above average. We had significantly higher scores in the past and we don’t see ourselves as a “slightly better than average” company. We used to be regarded by our clients as ‘Unique’ but in 2014 we dropped out of that zone. It’s a bit like a restaurant losing its Michelin Star – I was extremely keen to see if we could get back into the top bracket again this year.

So how did we do? How did you rate us?

2015 CLIENT FEEDBACK

This year, you gave us a Customer Relationship Quality (CRQ) score of 5.7 and a Net Promoter Score (NPS) of +37%.

I was a little stunned when the results came through as our NPS and CRQ scores had shot up dramatically. As many of you will be used to hearing me say at this stage, it’s quite a challenge to get your CRQ score to jump by more than 0.2 or your NPS to increase more than 10%. We had worked hard on a number of fronts over the past 12 months but the size of the improvement in scores still came as a surprise. So thank you for that vote of confidence in Deep-Insight – it really does mean a lot to us.

There’s still plenty for us to work on. We’re currently analysing each and every verbatim to figure out exactly how to improve our service even further. We will be sharing these results with you as early as we can in the New Year.

LOOKING FORWARD TO 2016

So there it is. 2015 is nearly over but we have some exciting things planned for next year.

Over the past few months, Rose Murphy has been talking to most of you about what you like and dislike about our current product offering. The feedback you have given to Rose, as well as the various suggestions you have made in this recent client assessment, will help us improve what we do and how we do it.

But for the moment, allow me to say a big thank you to each and every one of you for supporting us throughout 2015.

On a personal note, I’d also like to say a big thanks to the following (in no particular order other than alphabetical): Brian, Frank, Grainne, Jamie, Mark, Mary, Peter, Pim, Rose, Yvonne as well as to the rest of the wider Deep-Insight team who have helped to deliver a fantastic service to you – our clients – over the past 12 months.

Have a very peaceful Christmas and I look forward to seeing you all in the New Year,

John

The next question we get asked is “Is it really that high?”

The next question we get asked is “Is it really that high?” Susan – Sales Director

Susan – Sales Director Bill – Marketing Director

Bill – Marketing Director